Car owners have multiple advantages over the standard Filipino commuter, especially when considering the country’s dangerous roads and problematic public transport system. Many Filipinos have to struggle with finding a ride to get from Zapote to Alabang and endure the unbearable traffic situation of Las Piñas that made it into memes stating that the travel time from Las Piñas to Las Piñas was two hours. With a private vehicle, the stresses of traffic are somewhat lessened since the car owner can sit comfortably in their cars.

Las Piñas residents who’re looking to own a car should not forget to get insured since it can help car owners save money should they get caught in a vehicular accident. The only problem is that many people remain uninsured or underinsured because they see insurance plans as another expense on top of their costly purchase of the car.

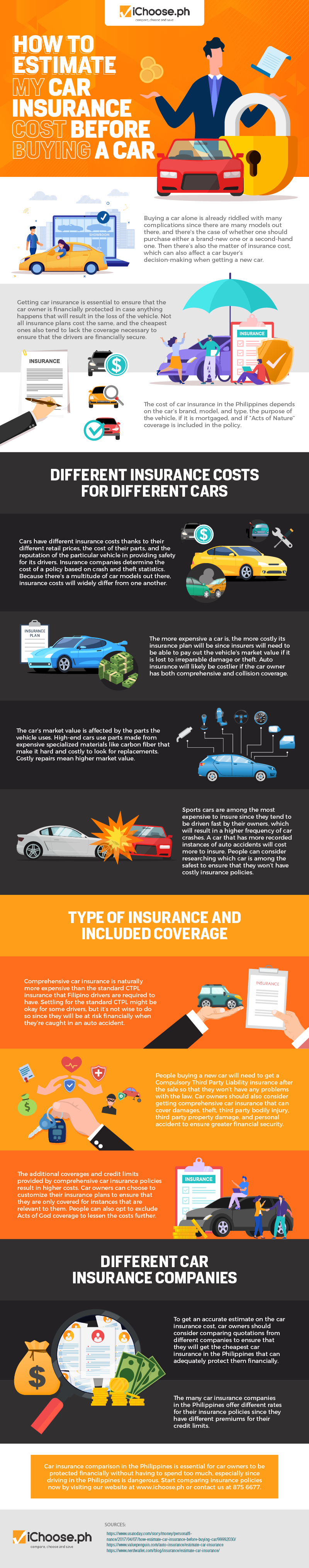

Car insurance Las Piñas isn’t necessarily expensive as long as buyers know how to get affordable insurance plans. The protection provided by insurance plans is enough to keep a car owner from experiencing significant financial loss when their cars receive considerable damage or are lost. The factors that affect insurance cost are the car’s market value, the type of insurance, and the insurance company people will trust.

Expensive cars have high insurance costs because insurers need to pay for the car’s market value. Expensive vehicles have costly spare parts that lead to pricy repairs. People can estimate how much they’ll pay for an insurance policy by considering what car they’ll get. They can cut their expenses when they get a cheaper vehicle. The car’s reputation among other drivers can also affect insurance costs.

What insurance plan car owners will get also affects how much they need to pay. CTPL or Compulsory Third Party Liability insurance is cheaper than comprehensive insurance plans since the latter has more inclusions than the former. CTPL insurance Philippines only focuses on liability while comprehensive insurance includes its own damage, theft, and personal accident in their coverage. Car owners also have the option to add Acts of God coverage to protect against storms like Ondoy.

There are many different car insurance companies, and they offer different prices for their policies. Filipinos can get the most affordable plan that can meet their needs should they lose their cars. See this infographic by iChoose.ph for more information on estimating car insurance costs.